Insights / Netflix Data / Netflix preschool: we know what great looks like, but what about good?

Netflix Data / 19th June 2023

Right now, everyone building a preschool kids’ brand wants to be CoComelon, Bluey or, more recently, Gabby’s Dollhouse. There’s a marked and understandable tendency to focus ambitions on where the big hitters are at. I hear it from clients, and they hear it from their management. I heard it from management myself on the regular when I was working in corporate: “Why can’t this show be more like PAW Patrol? Or Peppa Pig?!”

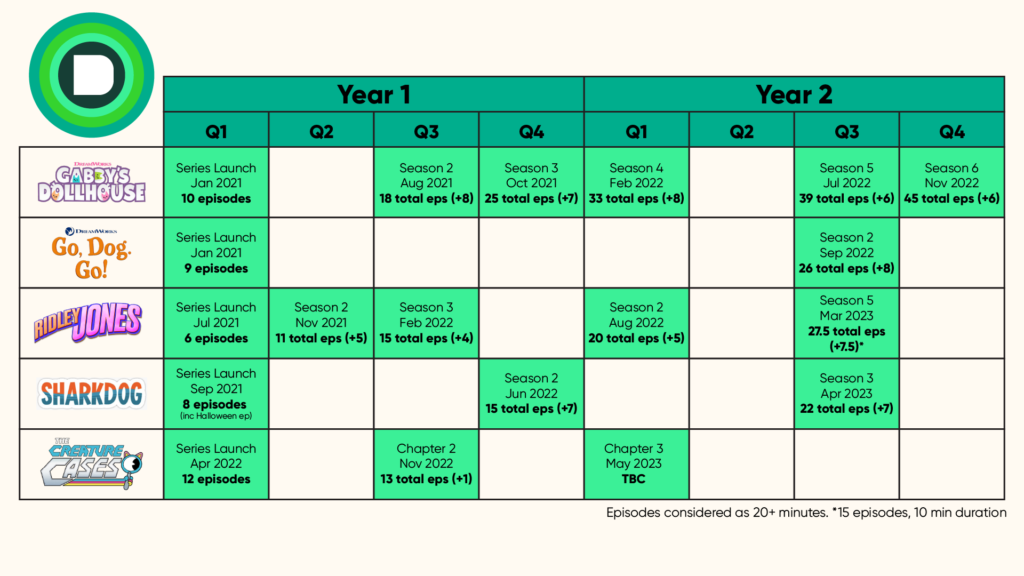

While it’s right and relevant to set your dreams on being the biggest of the big, this mindset is not necessarily practical or helpful when you’re launching a series or brand from scratch. Even if you’re going for more of a silver medal place (Little Angel, Blippi, PJ Masks) the entire podium generally have one thing in common: they’ve all been around for a number of years. Gabby’s Dollhouse stands out as the series that has achieved franchise status in the most efficient time period – just two years – and that has the full force of DreamWorks behind it.

Tracking these early steps of a franchise build can be tricky after the fact. In streaming, there’s only a lucky handful that pop in various top 10 rankings, so divining learnings or effective strategies is hard. Thinking about factors like number of episodes, season cadence and marketing without knowing how they impacted performance is wasted energy. That’s why, when the good folks at Digital i asked me to write for them again, I knew this was an area I wanted to unpack.

This show was given the star treatment by DreamWorks, even before launch. And DreamWorks know what they’re doing here, having overseen the only other streaming-originated show that has driven anything close to a true franchise, Spirit Riding Free.

Digital i have recently launched US data on their system, backdating to December 2022, so we ran the whole of 2021 and 2022. Market-wise, the data analysed below covers this region, plus the UK, France, Italy, Germany and Spain. In terms of metrics, we captured Viewer Minutes – a weighted consumption metric of total minutes viewed.

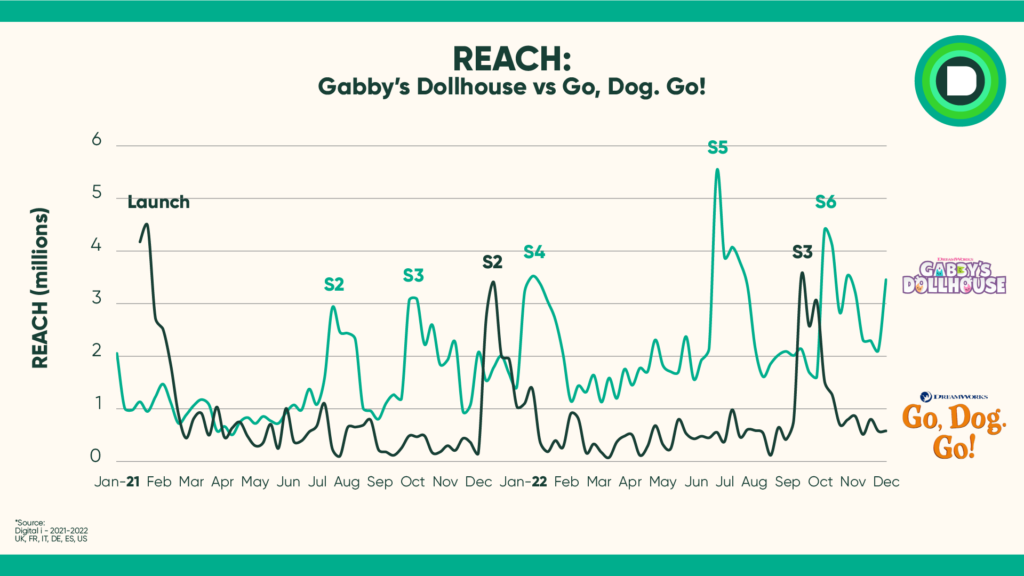

First up is Go, Dog. Go! This show launched three weeks after Gabby’s Dollhouse in late January 2021. It also came from DreamWorks Animation Television, but was a co-production with WildBrain Studios. In early months Digital i data shows Go, Dog. Go! as out in front of Gabby’s Dollhouse (this is where we need to keep that repeat viewing caveat in mind). Comparable data from Nielsen Streaming Content Ratings in the US, which captures this repeat viewing, had things the other way around. Go, Dog did well, but Gabby was definitively out in front.

Where Gabby clearly does build is in later months. This was helped by speedier episode roll-out. Subsequent season releases were optimised, in terms of timing and volume, to meet the strategic needs of the forthcoming toy launch. The second batch of episodes hit at the end of summer and more in October. Whereas, Go, Dog. Go! would have to wait until December before seeing any new content.

Another thing we can see here is the typical consumption curve for preschool content on streaming: big lifts for new episodes, compounding momentum when volume, fandom and marketing all pull. Go, Dog. Go! is still bringing in notable viewership with fresh seasons, and is on a potential build ramp. They just need to keep the new episodes coming.

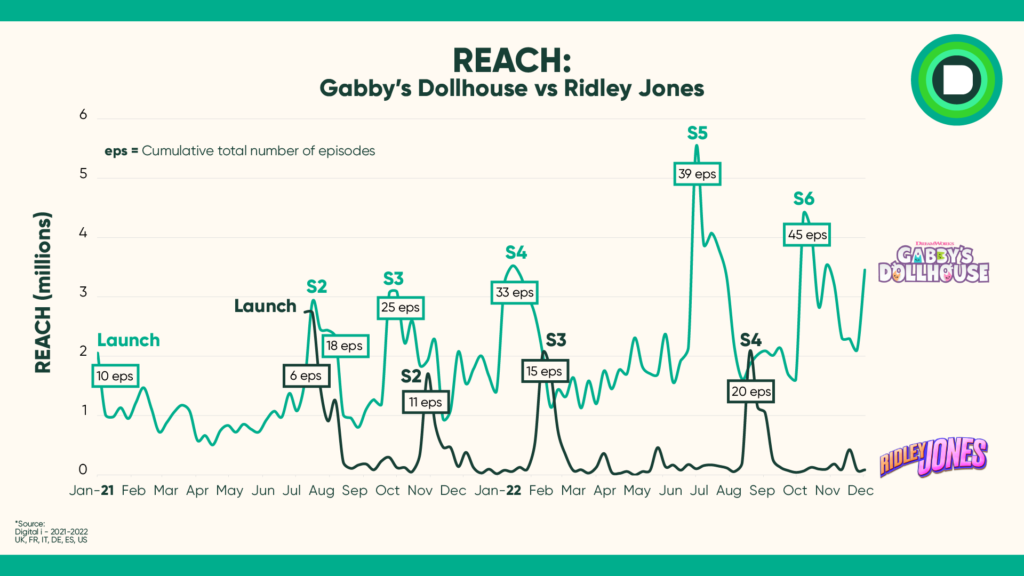

A few months after Gabby’s Dollhouse came the first Netflix Original preschool series from high-profile showrunner Chris Nee. Nee had been poached from Disney Junior where she had led the force on brand-defining titles like Doc McStuffins and Vampirina.

Ridley Jones is very much in the typical Nee signature style: high-end 3D animation, with music at the heart. It was animated by Brown Bag Films in Dublin, who had been instrumental in her hits of the past.

The show earned the accolade of being the first preschool series Netflix actually premiered on their Netflix Jr. YouTube channel. Netflix went for it, hard, with a significant marketing investment. The launch episode clocked over 20 million views on YouTube, enough to eat a marketing budget of a couple of hundred thousand dollars at least. And you can’t say it didn’t pay off. Digital i data shows the Ridley Jones launch was strong. The drop-off was more substantial, though. This wouldn’t have been helped by the fact that Ridley came out of the gate with much fewer available episodes than Gabby.

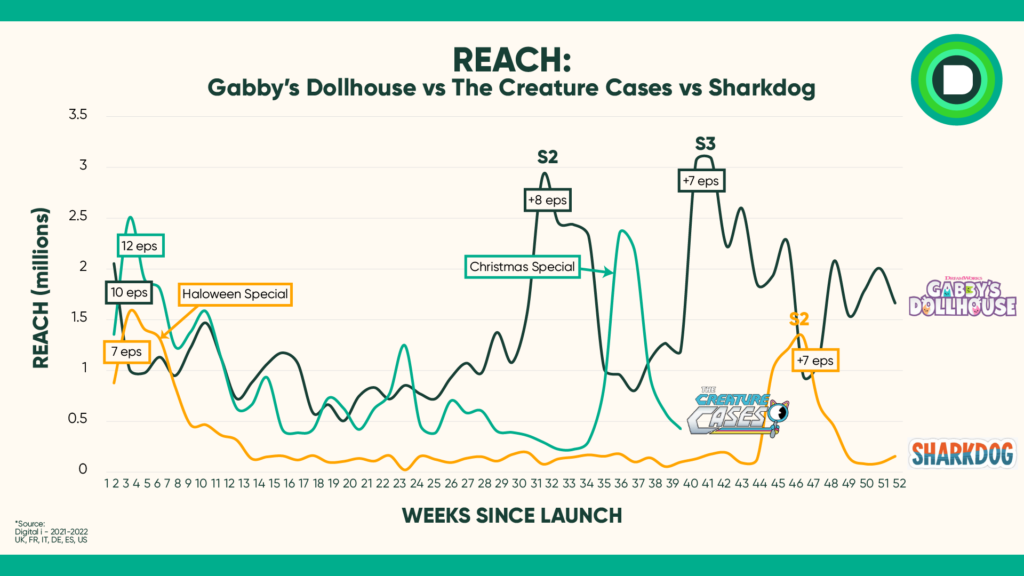

The Creature Cases and Sharkdog both came to my attention following outstanding launches on Netflix which pushed their performance into the Global Hours Viewed Top 10. They globally delivered 25 million and 34 million hours viewed respectively across two weeks. The only other preschool shows to feature in this ranking are CoComelon, Little Angel and Gabby’s Dollhouse.

The Creature Cases is produced by Sony Pictures Television – Kids. This division was created when Sony Pictures Television acquired Silvergate Media in 2019. This came with a great track record in creating hit kids’ content like Octonauts and Hilda. The producer of Sharkdog also has somewhat of a track record. You may have heard of them, they’re called Nickelodeon.

Launch success for both series holds true in Digital i data where we can see viewership roar. The Creature Cases had good ongoing engagement after launch, and clear demand when the single Christmas episode dropped. Sharkdog fell harder, not really buoyed by a Halloween special a few months after launch, though season 2 came back strong. But could this question about episode count be the crux of the issue?

We know that Gabby’s Dollhouse has been given the whole shebang from DreamWorks in terms of marketing, PR, franchise, you name it. Having said that, boiling things down to real basics, it had an obvious advantage before any of those happened. The show quickly reached a critical volume of content. When you map it out over the various series life cycles, it’s really clear. Gabby hit 25 episodes before its first year was done. Back in the heyday of linear, this type of volume would have been quite typical, particularly with preschool content. A linear season order, usually 20 – 26 episodes, would have rolled out over 12 – 15 months; and to clarify further, a 20-ep order would DEFINITELY be done in 12 months.

The advent of streaming brought all sorts of squiffiness as to what constitutes a ‘season’. In linear, marketing was more commonly focused around ‘new episodes’. Streaming is in favour of ‘season’ comms, which, is a more appealing message for the consumer.

In reality, content volumes come home to roost no matter what your terminology. Audiences, particularly kids, need enough to get their teeth stuck into. That applies for both launch (where volume was lighter on Ridley Jones and Sharkdog) and ongoing (like poor Creature Cases). Obviously, things like marketing factor in; was Ridley’s splashy YouTube spend better than the more diversified run up of Gabby? It would seem at the end of the day, what you’re driving folks to, needs to be enough to get them immersed.

I guess the question is, why does Netflix keep roll-out volumes so stingy? Animation production pipelines can definitely be painful, with things often going over. Add localised production into 34 languages and delays are practically guaranteed. But you need to hold your nerve and go with what will make the content work. Particularly when, like Netflix, your sole focus is your platform, unlike Disney where series might need to stay in line with commitments across businesses like consumer products and parks.

Unfortunately, it’s not like producers can dictate content roll-out to platforms, though you might think DreamWorks held some leverage. It’s just confusing that Netflix wouldn’t prioritise giving their content investments the best possible chance of success. Success that’s been proven possible by Gabby’s Dollhouse.

If you’re interested in understanding more about our SoDA platform and SVOD data can benefit you, get in touch.

Know your audience.

Join the viewing revolution.

Blog by Emily Horgan –

Independent Kids Media Consultant

Twitter: @emohorgan

LinkedIn: Emily Horgan

Speak to an expert to find out how our intelligence platform will revolutionise your TV reporting & SVOD research