Insights / News and Opinion / Battling for British Content

News and Opinion / 12th April 2022

Flagship British content has long been associated with the UK’s public broadcasters. For years, the nation’s top dramas had their first outing on BBC or ITV.

This didn’t change when streaming services first entered the scene. Even today, in the golden age of streaming, the highest ratings still come from linear TV shows.

The game changing moment arrived when a South Korean dystopian series became a household hit, not just in South Korea, or in Britain… but all over the world. Even though Netflix is a subscription service, requiring access to a paid account to watch content, Squid Game was the second most-viewed drama of 2021 in the UK.

Although US content remains the dominant keystone for global streaming platforms, hit shows from all over the world are starting to emerge. The glass ceiling is gone. When Netflix first hit the UK scene, Hollywood’s latest hits dominated the top streaming charts. More recent data shows that British audiences value localised content above starry American glamour. British content creators: get your pitches ready because localised content is rising to a position of prominence in the streaming wars.

Netflix launched in the UK in 2012 with a content catalogue packed full of acquired US content. A year later, when House of Cards burst onto the scene, people started taking note. Could this innovative service also make original content that sticks? In the first few years big US productions like Breaking Bad, Orange is the New Black and Stranger Things were critical for subscriber acquisition. However, over the years Netflix has leaned into localisation, as a method of cementing market dominance.

What did this mean for the UK?

Monarchy, history, and a generous helping of artistic licence.

In late 2016, The Crown became Netflix’s first British Original, with a gargantuan budget of approximately £100 million for the production of the first season.

During the early 2020s and late 2010s, UK Originals became some of the platform’s most-viewed shows for British audiences. Aside from Squid Game, The Crown is the show with the highest reach on Netflix UK since 2018. In 2021, Bridgerton was the second-most viewed show. Yet again, UK profiles only watched the ubiquitous Squid Game more. Sex Education and Behind Her Eyes also achieved high viewership in 2021. In the domestic British market, the aforementioned shows outperformed global hits like Money Heist.

So what exactly shapes Netflix’s localisation strategy when it comes to the UK?

Well, all the high performing British Netflix Originals have several key traits in common.

For one, they are all high-budget dramas, allowing for striking visuals and eccentric, colourful characters. It seems that for Netflix UK, big spend = big results.

Bridgerton is a period drama set in London’s regency-era. It has a fantasy element of a racially integrated society in a way that has never been seen in period dramas.

Sex Education shows a generic secondary school, featuring relatable but wacky teenagers navigating their messy way through adolescence. Keen-eyed Brits will find many things about the school setting unfamiliar. The school features Breakfast Club-style lockers, letterman jackets and American footballs flying through the corridors…

In spite of the globalisation (read: Americanisation) of much of the popular British Original content, more recently there has also been a push for less ‘travelable’ localised content. Local Originals like Stay Close, The Stranger and Behind Her Eyes characterise the 2020s. This is content that wouldn’t look out of place on BBC or ITV. Consequently, these localised Originals do not achieve a high viewership on an international stage. However, they are key drivers for engagement in the local market.

While Netflix is leaning into BBC-style high budget drama, Prime Video has taken a different approach to UK originals.

Amazon’s journey into localised originals began when the BBC fired Jeremy Clarkson in 2015. Many saw him as a liability, while Amazon saw him as an opportunity. They acted quickly to sign him up, along with James May and Richard Hammond to make a new (albeit familiar) show The Grand Tour. Released in 2016, the show is Amazon’s longest running original production. Its 4 seasons on Prime Video still generate high viewership for the platform.

Amazon saw the potential to capitalise on this audience, releasing Clarkson’s Farm in summer 2021. This ended up surpassing viewing of The Grand Tour to become Prime Video’s most viewed British programme in the UK. However what is clear is that these shows have extremely localised audiences.

Since 2018, Clarkson’s Farm has the 3rd highest reach of any Amazon title in the UK, but didn’t manage to crack the top 50 for any other country. Additionally The Grand Tour is the UK’s top programme since 2018, but only managed to crack the top 10 in Italy where it ranked in 9th.

It is clear to see that Netflix’s popular British content is almost always scripted and usually dramas. Meanwhile on Prime Video, unscripted content like the aforementioned titles along with Ramsay’s Kitchen Nightmares and a show hosted by another of the Top Gear Alumni – James May: Our Man in Japan.

Recently Netflix and Prime Video invested into British production studios in order to produce more British Originals. Earlier this year, Amazon announced a new multimillion pound deal with Shepperton Studios. Netflix is negotiating with developers in Enfield and the council to rent the entire Segro Park development, which comprises three vast warehouses/studios.

Now that Netflix and Prime Video are leading the charge with their pursuit of British content, we expect more streaming services to follow. One of Apple TV+’s biggest hits, Ted Lasso is set in the UK despite being an American production. ITV recently announced their new service, ITVX, which will require heavy investment into British based content. Earlier this week, Paramount+ unveiled the new slate of British originals in production ahead of their UK launch this summer.

With more streaming services expected to enter the UK in the coming years, it is inevitable that they will want to produce high performing British content.

If international content localisation strategies interest you, be sure to attend the ARF Audiences x Science conference where Matt Ross will be discussing whether Hollywood is losing its influence over global audiences.

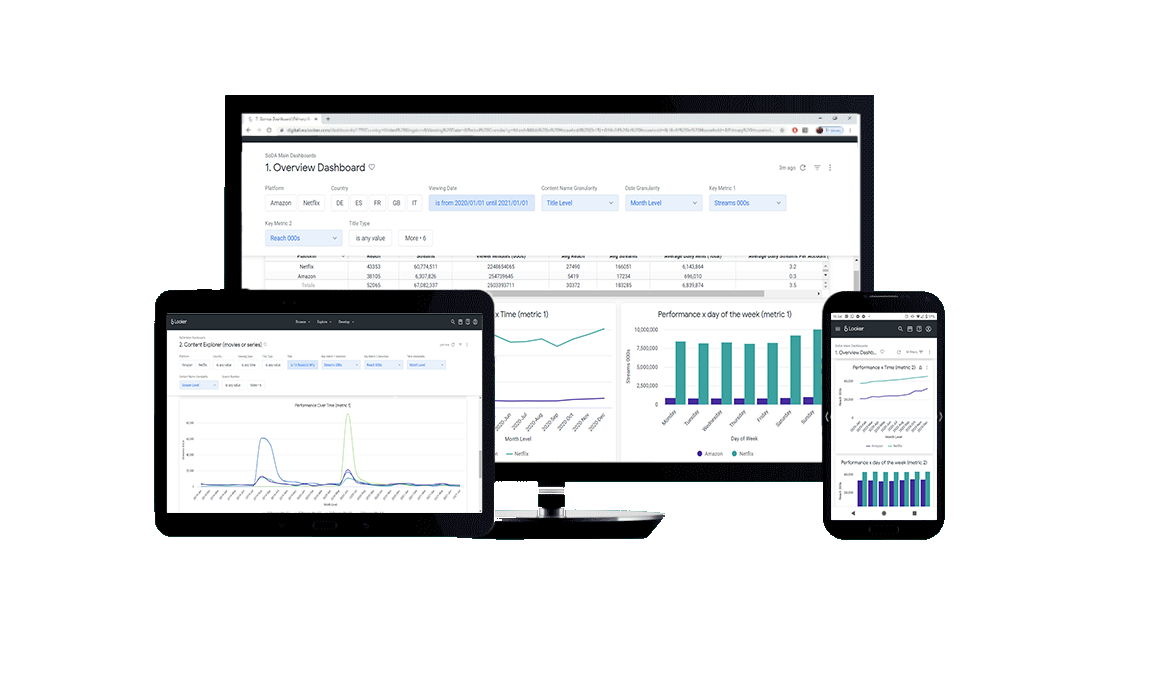

To understand more about European viewing trends, get in touch or book a demo of our award-winning SVOD viewership analytics platform, SoDA.

Speak to an expert to find out how our intelligence platform will revolutionise your TV reporting & SVOD research